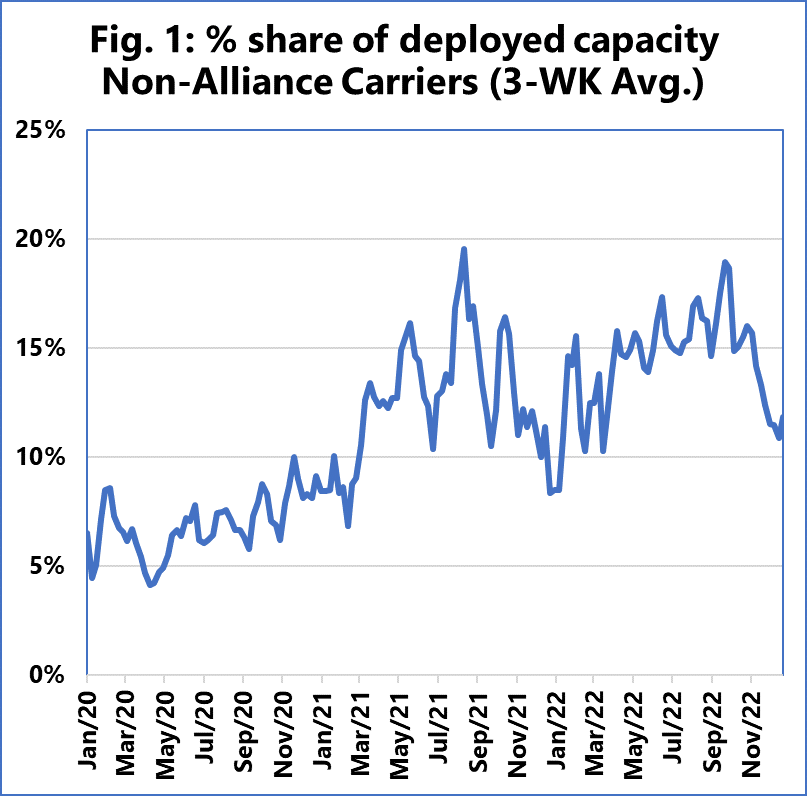

The market share of carriers outside of the main alliances on the transpacific is falling back after rising in recent years, according to one analysis.

Gary Howard | Nov 04, 2022

Sea-Intelligence noted in a recent analysis that non-alliance carriers accounted for around 5% of Transpacific trade as of January 2020, and peaked at almost 20% in August 2021.

The increase in market share was down to the strong market for container lines through 2021 and early 2022, typified by high rates driven by congestion. High demand for container ocean transport outstripped supply over the period, leaving insufficient capacity and a very tight market for vessels.

Related: ONE forecasts tougher H2 as demand and freight rates decline

“This significantly reduces the barriers of entry for smaller carriers who can get in while the market is hot, and then exit when it blows cold. This is exactly what happened, as a large number of newcomers entered the trade,” said Alan Murphy, CEO, Sea-Intelligence.

Sea-Intelligence.com, Sunday Spotlight, issue 588

Related: Drop in US inbound container volumes accelerates

Just as new carriers entered the market when times were good, they leave as fortunes fall. With freight rates falling and congestion continuing to improve, profit on the trade is harder to come by.

“Much of this additional niche carrier capacity has been sourced from exceptionally high-priced vessel charters for small and inefficient vessels, which in turn has been entirely fuelled by the exceptionally high spot rates, and as these have been coming down fast in recent months, many of these small-vessel services will quickly approach the point where they become loss-making, forcing a swift closure and exit from the market,” said Murphy.

Murphy added that the newcomers’ exit from the market was expected, as their time in the market was only ever going to last as long as elevated spot rates did.

Copyright © 2022. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Reference: https://www.seatrade-maritime.com/containers/alliance-carriers-winning-back-transpacific-market-share