Southeast Asia is subtly growing as an important part of global commerce as emerging risks shake the region. But as the recent brief border skirmish between Thailand and Cambodia revealed, regional connectivity also faces challenges from within.

“ASEAN is already among the world’s top five economies. Based on current growth projections, we are on track to climb to the top four by 2030,” said ASEAN Secretary-General Kao Kim Hourn

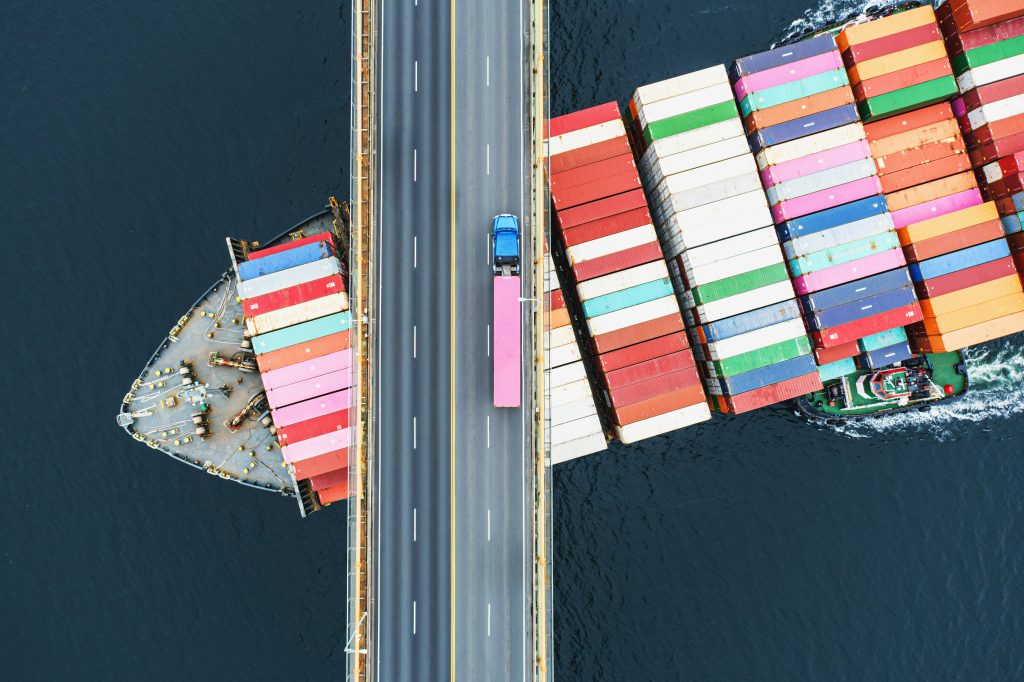

SEA countries have long used economic corridors to connect markets and enhance regional self-reliance. As global commerce faces growing tensions, these established and evolving networks are playing a more prominent role. But as the global economy continues to shift, could these corridors be key to Southeast Asia’s emerging role in supply chains?

Fragile supply chains

On April 5, 2025, US President Donald Trump imposed a 10% tariff on almost all imports to the United States. He also raised tariffs on Chinese goods from 34% to 104%, claiming that other countries were taking advantage of the US.

These bold trade actions caused major disruptions in the global economy. Supply chains were affected, and companies faced growing uncertainty. Large firms like Apple and Nvidia, which rely heavily on Asian manufacturing, saw sharp drops in market value due to concerns about rising costs and unpredictable trade rules.

Amid these challenges, Southeast Asia is becoming an attractive alternative for companies looking for stable and cost-efficient production. Countries such as Thailand, Malaysia and Indonesia are drawing more foreign investment thanks to competitive labor markets and supportive government policies, including Thailand’s Eastern Economic Corridor and Indonesia’s Omnibus Law. Even Chinese companies like BYD, Xiaomi and Midea are expanding their operations in the region.

However, the recent border skirmish between Thailand and Cambodia in July 2025 exposed latent risks. The five-day conflict from July 24–28 disrupted border trade at key crossings in Sa Kaeo and Trat provinces, halting freight movement and stranding cargo. Bilateral trade between the two nations reached $3.9 billion in 2024, with over $2.8 billion traded in the first five months of 2025 alone.

While a ceasefire has been in effect since July 28, the situation remains fragile. According to Thailand’s Deputy Prime Minister and Finance Minister Pichai Chunhavajira, the conflict has already cost Thailand approximately $310 million, with projections indicating up to $5.6 billion in economic losses over a prolonged three-month standoff.

Enter economic corridors

Emerging in the late 1990s through an Asian Development Bank (ADB) initiative these corridors seeks to bridge the vital link between infrastructure and economic activity. This is done through organizing investments in transport, energy and telecommunications, the ADB promoted regional integration and trade.

These corridors now drive domestic and international trade across Asia by fostering connectivity between economic hubs and creating network effects that build regional self-reliance. As a result, Southeast Asia is projected to outpace China in GDP and foreign direct investment growth, with Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam expected to grow by 5.1% annually until 2034.

“As a result of strong domestic growth and the China +1 strategy, we are increasingly optimistic that Southeast Asia will outpace China’s growth in both GDP and FDI in the next decade. However, multinational investments will be highly contested, with the competition between countries improving outcomes for both businesses and consumers,” said Charles Ormiston, the Bain Advisory Partner.

Key Economic Corridors in Southeast Asia

Luzon Economic Corridor

The Luzon Economic Corridor (LEC) is a partnership between the US, Japan, and the Philippines to improve infrastructure and trade across key areas like Subic, Clark, Manila, and Batangas.

Major projects include railways, port upgrades, and expressways. These are all aimed at speeding up transport and supporting industries such as semiconductors, clean energy, agriculture, and manufacturing.

The LEC links regions that generate over 60% of the Philippines’ GDP—with Metro Manila at 36%, Batangas at 17%, and Central Luzon at 9%. Each area plays a strategic role: Batangas in manufacturing and exports, Central Luzon in logistics and agri-industry.

For example, equity venture firm Aboitiz InfraCapital established the TARI estate in Tarlac. Launched in 2024, the TARI Estate is currently being built to support export-oriented industries like electronics, logistics, food processing and e-commerce.

Once fully operational to strengthen the city’s role in Central Luzon’s economy while also being positioned as a supply chain hub, enhancing regional value chains and supporting high-demand sectors like cold storage and packaging.

Subic is also positioned as a key region in the country’s supply chain. Currently FedEx, UPS, and Lufthansa Technik AG are pouring in investments and financing to the building and maintenance of the expansion of Clark International Airport which is set to be operational by 2026.

“With its own international airport and accessibility to Northern Luzon and Metro Manila via expressways, Clark is the perfect spot for air freight and aviation services—and international companies are certainly taking notice,” Bases Conversion and Development Authority president and chief executive officer Joshua Bingcang said.

Thus, Sanyo Denki Philippines based in the Subic Bay Freeport Zone, has partnered with First Gen Corp. to power its four factories and technology center with 5,500 kW of geothermal energy from Negros Oriental. This marks the company’s first step in integrating renewable energy into its operations, with support from First Gen and Pi Energy in monitoring and optimizing energy use.

Thailand Eastern Economic Corridor (EEC)

Thailand’s Eastern Economic Corridor spans Rayong, Chonburi, and Chachoengsao, covering 13,285 square kilometers. Over 30 years, it has become a major industrial hub, with key developments like Map Ta Phut Industrial Estate and Laem Chabang deep-sea port.

Furthermore, Thailand is pushing forward with the long-delayed U-Tapao Airport and Eastern Aviation City project in the Eastern Economic Corridor, with construction expected to start between April and May 2025. Despite rail delays, authorities are proceeding with construction, possibly reducing the terminal’s initial planned capacity from 10–12 million to 5–6 million passengers. The project will still allow for future expansion as needed.

The airport and aviation city are seen as key to boosting logistics, industry, and tourism in the EEC. The $8.7 billion project will cover 6,500 rai and include terminals, aircraft maintenance facilities, a cargo village, and a commercial center.

The Greater Mekong Subregion Economic Corridors

According to ADB in 2021, the Greater Mekong Subregion (GMS) economic corridors improved logistics, lower transport costs, and supported cross-border movement. Specifically, the GMS Regional Investment Framework 2024-2026 comprises multiple economic corridors. It outlines over 128 infrastructure worth $17.7 billion.

For example, one of the earliest was the East–West Economic Corridor. It links Danang, Vietnam to Mawlamyine, Myanmar through Lao PDR and Thailand. It reduced cargo transit time from 8 days to just 27 hours, while combined connectivity with the North–South Economic Corridor shortens travel from Yangon to Bangkok to 9 hours.

Moreover, the 7.7-magnitude earthquake in Myanmar on March 28 severely damaged key infrastructure, including the Sagaing Bridge, Yangon Port, and inland river ports, halting exports of garments, tin, and agricultural goods. Factory closures and transport delays triggered ripple effects across Southeast Asia, increasing shipping congestion and costs. Despite efforts to restore operations, Myanmar’s regional trade role remains strained.

The East-West Economic Corridor (EWEC) is currently projected to boost transborder trade by at least 50% and stimulate local economic activity along Highway 12 through tourism, logistics hubs, and small businesses.

Moreover, Cambodia recorded a 38.3% increase in the first quarter of 2024. Statistics from the General Department of Customs and Excise show Cambodia’s trade volume reached $40.94 billion from January to September 2024, and the World Bank projects it could grow to $100 billion in six years.

Vietnam is among the world’s top 20 trading economies, with import-export turnover reaching nearly 800 billion USD in 2024. It has signed 17 trade agreements with over 60 partners, helping diversify exports and maintain strong, stable growth.

Once war-torn, Vietnam now holds upper-middle income status with a trade surplus for nine straight years. In 2025, it ranks 32nd in economic size and targets over 8% growth, with exports driving development despite global trade challenges.

Intra-GMS trade has also facilitated increased specialization. Cambodia’s exports are 78% concentrated in five sectors, especially textiles. Vietnam and Thailand also export electronics, food, and wood products. Myanmar and Laos still show weaker RCA in regional exports, especially in textiles and electronics.

Indonesia-Malaysia-Thailand Growth Triangle (IMT-GT)

The IMT-GT Vision 2026 prioritizes five corridors to boost regional integration. EC1 links agriculture areas to Malaysia and Singapore; EC2 supports food and halal supply chains near Sumatra; EC3 improves inland connections via the ASEAN Highway Network; EC4 facilitates maritime and oil trade; EC5 strengthens maritime links with Southern Thailand.

Key to success are investments in transport, Information and Communication Technology (ICT), and power infrastructure, along with regional financing and public-private partnerships. For example, Malaysia is constructing a RM492 million inland port in Perlis to strengthen trade ties with China and Thailand and enhance regional railway connectivity.

The Perlis Inland Port (PIP), set to finish by late 2025, will handle up to 300,000 containers a year—twice the capacity of the nearby Padang Besar terminal. It will connect to two railway lines: the current route to Penang Port and the future East Coast Rail Link (ECRL) to Kota Bharu.

These train routes will link to the Pan-Asian Railway and Asean Express, helping move goods from southern Thailand through Malaysia to China. The ECRL, costing RM50.27 billion and backed by China, will connect Port Klang to Malaysia’s east coast by 2028 and strengthen Malaysia’s trade role.

“PIP will play an important role in the connectivity of the country’s main rail network with international rail services such as the Pan-Asian Railway and Asean Express, which will open new opportunities for trade and economic cooperation between Malaysia, Thailand, Laos and China,” said Transport Minister Anthony Loke

Malaysia aims to raise trade with Thailand to US$30 billion by 2027, from US$24.8 billion in 2023, while total trade with China hit RM484.12 billion in 2024. Despite security concerns in southern Thailand, where the country’s predominantly Malay-Muslim population has struggled for independence, inland port and rail expansions are viewed as critical to Malaysia’s trading future.

Brunei Darussalam-Indonesia-Malaysia-Philippines East ASEAN Growth Area (BIMP- EAGA)

BIMP-EAGA Vision 2025 aims to drive sub regional growth through eco-friendly manufacturing, climate-smart agriculture, and cross-border tourism in less developed areas. It targets a 10% rise in intra-EAGA trade, $240 billion in exports, and $66 billion in foreign direct investment.

In 2025, the Malaysia External Trade Development Corp. (MATRADE) in Manila launched several trade initiatives to strengthen economic ties with the Philippines. These efforts aim to expand market access for Malaysian businesses and support Philippine firms entering Malaysia’s market.

MATRADE is focusing on sectors such as halal, ICT, digitalization, construction, and business services. It is organizing mmajor events like MIHAS 2025 in Kuala Lumpur and the Philippine SME Business Expo in Manila to connect exporters and buyers.

“Together, we can create more opportunities for development and growth for both of our countries, as we as a region march forth in our pursuit for economic and social betterment of our people” said Dato’ Abdul Malik Melvin Castelino, Ambassador of Malaysia to the Philippines.

The agency also held a halal roundtable in February 2025 to explore partnerships and improve certification and trade cooperation. These activities promote collaboration between businesses and government agencies from both countries.

In the construction sector, Malaysian companies joined Worldbex 2025 in Manila to showcase products and explore partnerships. Trade between the two nations reached $8.35 billion in 2024, showing steady growth in exports and imports.

A region in motion, but not without friction

Southeast Asia’s economic corridors are becoming more interconnected through ASEAN’s Master Plan on ASEAN Connectivity (MPAC) 2025. MPAC promotes sustainable infrastructure, digital innovation, logistics, regulatory alignment, and people mobility. As of 2024, over 80% of its 143 key measures have been completed or are underway

However, the journey ahead demands more than infrastructure. It requires geopolitics-aware planning, trust-building between neighbors, and a supply chain strategy that accounts not just for cost, but for continuity. The recent border clashes between Thailand and Cambodia— which caused over 10 billion baht in estimated damages and triggered emergency fiscal measures serves as a reminder that economic cooperation cannot thrive without regional stability. Friction, may it be in policy, perception, or even physical borders, remains as one of the greatest disablers of shared progress.

Reference : Southeast Asia’s Economic Corridor: Resilience Amid Friction