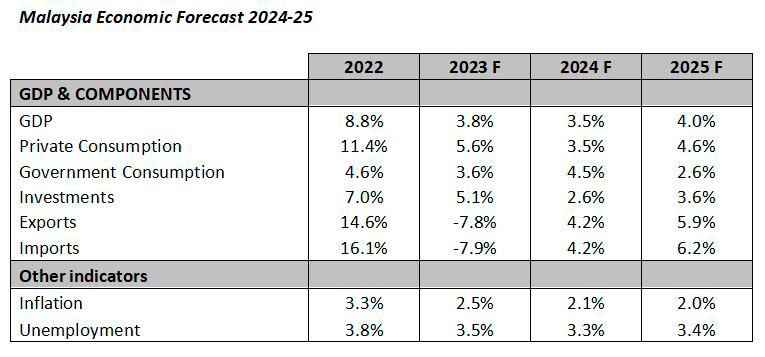

KUALA LUMPUR: Economic growth for 2023 will be below 4% as we forecast this time last year. This is positive but slower than in the past because of the transition to a new era of lower underlying growth due to the damage of Covid-19 policies. We see slower growth around 3.5% in 2024 compared to the consensus of 4-5%.

Also as we predicted, headline inflation has slowed to 1.5% in December and 2.5% for the full year. We forecast that headline inflation will remain low at around 2.1% for 2024. Core inflation is 1.9% and slightly higher than normal but is falling and will continue to slow. Against this background Bank Negara (BNM) held interest rates steady which is the right policy.

The cost of living has been a big challenge for everyone below the T20 threshold, prices remain high and there is not much that can be done to bring them down. So the focus for 2024 must be on raising incomes.

Unemployment is low but underemployment remains stubbornly high. Labour market reforms must be prioritised.

Investment approvals have been high but actual investments in the private sector both domestic and foreign direct investment remain moderate after a trend decline since around 2016.

Growth potential is held back by low investment and this is a structural problem that must be addressed.

Net trade is still positive albeit lower than normal, external factors have held down exports but imports have also fallen. Exports have benefitted from the weaker ringgit during 2023 and this continues into 2024.

Fiscal policy for 2024 looks stronger with spending in Budget 2024 only slightly higher, revenues forecast to grow and the deficit lower in total and percentage terms.

Many of the current problems are due to the policies of earlier governments that caused significant structural damage, closing many companies and wiping out the savings and pensions for millions of people.

Despite these legacy issues Prime Minister Datuk Seri Anwar Ibrahim has stabilised the situation as finance minister and set the groundwork for reforms.

Nonetheless we do not expect significant economic impacts from the main reform areas this year. Subsidy rationalisation will not cover petrol subsidies which account for more than 80% of the total. The Progressive Wage Model will be run in a very small pilot programme so there will be no major change to wages from that until at least the end of 2025.

Civil service pension reforms will only affect new hires and will have no impact on pension costs in the short-term. Tax changes are small and ad hoc may cause cascading effects especially in logistics but there are no significant benefits to fiscal policy from this source.

The challenges and opportunities for the Malaysian economy in 2024 are clear, external uncertainty but domestic stability to support reforms.

In this environment monetary and fiscal policy should be conservative with no major changes. Tax reforms such as an e-payments tax as an alternative to GST should be considered to find better revenue sources. Good governance to reduce wastage, leakages and corruption is essential.

The new Padu database will set the foundation for targeted subsidy rationalisation and there must be more focus on raising incomes and better job prospects. Investment and supply-side reforms remain the key challenge and the New Industrial Master Plan offers very little to address this issue.

The social economy must focus on pensions, social protection through Padu, long-term care for the aging population and also abolishing student loans. These reforms are achievable now that the macroeconomic environment is stable.

Overall the 2024 will be another year of transition with focus on structural reforms.

This article is contributed by Professor Paolo Casadio an economist at HELP University and Professor Geoffrey Williams an economist and Provost for Research and Innovation at Malaysia University of Science and Technology. The views expressed are those of the writers.

Reference: https://thesun.my/business/2024-will-be-another-year-of-transition-for-msian-economy-FG12055473