The global container shipping industry is at the cusp of a major configuration in terms of fleet age as newbuilds prepare to enter service over the next two years and replace an aging fleet. According to the industry trade group BIMCO, the container fleet has reached its highest average age since 2010.

BIMCO is reporting that for the first time in over a decade, boxships have reached a new peak with an average age of 14.2 years. Over the past 13 years, they report the average age has increased 4.3 years from when the average age hit a low of 9.9 years in August 2010. The current average of the ocean-going vessels is the highest of the three main shipping sectors, with the dry bulk fleet average age standing at 11.9 years whereas tankers on average are 12.8 years old.

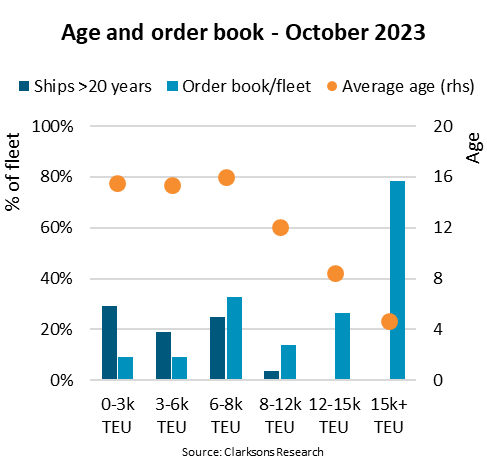

In its analysis, BIMCO highlights that over the 2010-13 period, a total of 2,516 ships were delivered while 1,384 ships were recycled. This development, however, has not been sufficient to keep the average age down. This comes from the fact that 21 percent of ships in the container fleet are older than 20 years.

“Perhaps more importantly, nearly 70 percent of all container ships are over 10 years old,” said Niels Rasmussen, BIMCO chief shipping analyst. “All ships built according to slow steaming principles so far, have been delivered within the last 10 years, allowing for lower energy consumption per container carried.”

The age of the vessels alone makes them prime candidates for recycling in the coming years, even before considering the pending emerging emissions regulations as well as carriers’ moves to increase efficiency through slow steaming and newer technologies. Carriers are also increasing the size of their vessels on key routes to realize greater efficiencies and prepare for anticipated future increases in demand. BIMCO highlights that of the ships older than 20 years, the segments for vessels with a capacity of less than 2,999 TEU and 3,000 to 5,999 TEU contribute 76 percent and 16 percent respectively of the older fleet. BIMCO reports that fleet renewal in the past years has been focused on the post-panamax segments.

While it is evident the global boxship fleet is aging, record newbuild orders indicate the industry is prioritizing fleet renewal, while also focusing mainly on large ships. This means that over the next few years, the average age could decline as the newbuilds enter service and older ships head to yards for recycling.

BIMCO’s analysis of the current order book highlights that it is largely focused on the largest ships, and the number of ships on order in the size segments below 6,000 TEU is significantly below the number of ships older than 20 years in the same segments. For vessels below 2,999 TEU capacity, 317 ships are on order, but 994 ships are more than 20 years old. Similarly, the size segment 3,000-5,999 TEU has 210 ships older than 20 years but only 100 ships on order.

“The orderbook contains 750 ships to be delivered before the end of 2025,” notes Rasmussen. “Depending on the number of ships recycled, this should allow the average age to decline and the average energy efficiency of ships within all size segments to increase. In addition, the share of ships able to use alternative low carbon fuels will increase.”

Despite operating an aging fleet, shipping liners continue to demonstrate according to BIMCO a determination to hold on to their fleet. The analysis shows that despite ships becoming older and confronted with a significant downturn in container freight rates during the past 15 months, recycling of ships this year has remained low compared with the past decade. In the first nine months, 57 ships have been recycled compared to 81 on average during the previous 10 years.

Reference : https://maritime-executive.com/article/containerships-reach-highest-average-age-despite-newbuilds-bimco-reports