The container shipping segment could be beginning a much longer and more challenging period according to a new analysis from Sea-Intelligence. The Danish analytics firm issued a forecast this week highlighting that the container segment’s current level of overcapacity could take a minimum of four years to come into balance and could be pushed out to 2030 or beyond.

“The market is heading into a traditional down cycle, as 2023 is seeing significant excess capacity being delivered, and in all likelihood, the same will happen in 2024,” comments Alan Murphy, CEO of Sea-Intelligence. His firm paints a troubling picture for the industry in response to the questions of when the current overcapacity will come into balance and how the industry will overcome its current challenges.

Many in the industry had predicted that the worst of the collapse in rates would be overcome by late this year but looming is the question of capacity. More people are now forecasting that the industry will be forced to turn to more aggressive disposals as slow steaming and even idling tonnage alone with not achieve balance versus the onslaught of capacity due to arrive in the next three years into the sector.

Alphaliner calculates that even after the large-scale deliveries already completed this year, the tidal wave of capacity growth is yet to come. MSC for example has received delivery of a large portion of its mammoth 24,000-plus TEU ships, the largest in the industry, while others including OOCL, ONE, and Hapag-Lloyd have also begun to receive their new ultra large container vessels. Alphaliner’s data however shows the orderbook for the top carriers still stands at approximately seven million TEU, representing a further 25 percent gross increase in capacity before potential dispositions for scrap.

BIMCO in its market analysis this week highlighted that the container segment is holding on to tonnage. As a result, they noted that the fleet has become the oldest in memory with an average age of over 14 years, making the container fleet older than either bulkers or tankers.

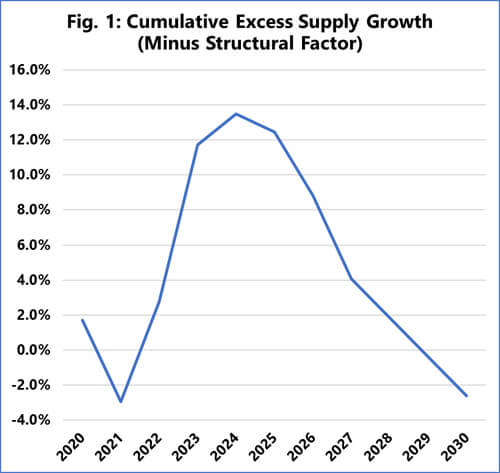

Sea-Intelligence in its analysis creates the potentially most positive scenario based on recent history. They used annual volume growth of just under four percent starting in 2024, matching the growth rate from 2011 to 2019 after the Great Recession. After the near-term supply surge, they also moved to a modest 1.3 percent post 2026.

(courtesy of Sea-Intelligence)

Using what they admit are “rather optimistic assumptions,” Sea-Intelligence still presents a graph showing oversupply peaking at nearly 14 percent and taking years to fall back towards an in-balance situation. Murphy notes that the worst overcapacity will be seen in 2024, and by 2026, a third of the overcapacity will have been absorbed.

“Absent an explosion in global container demand, another pandemic soaking up capacity, or carriers laying up a significant share of the global fleet and ordering no more vessels, then we could see a 2019-level of supply/demand balance in 2028. Gaining this balance in 2028 would imply an 8-year span – the same as the cycle from the financial crisis until balance was restored again in 2017,” concludes Sea-Intelligence.

While they conclude 2028 is achievable, Sea-Intelligence also notes that if there is lower demand growth, or the industry pushes ahead with more orders for even modest supply growth, the result will be to push out the recovery. They conclude any of these factors would delay the industry from achieving capacity balance till 2030 or beyond.

Reference : https://maritime-executive.com/article/report-containership-overcapacity-could-last-to-2030-or-beyond